JustTheFacts Max

JustTheFacts Max![]() -

December 20, 2025 -

Business

Economy

Coachella Valley

Palm Springs Greater Area

-

399 views -

0 Comments -

0 Likes -

0 Reviews

-

December 20, 2025 -

Business

Economy

Coachella Valley

Palm Springs Greater Area

-

399 views -

0 Comments -

0 Likes -

0 Reviews

JTFMax Biz:

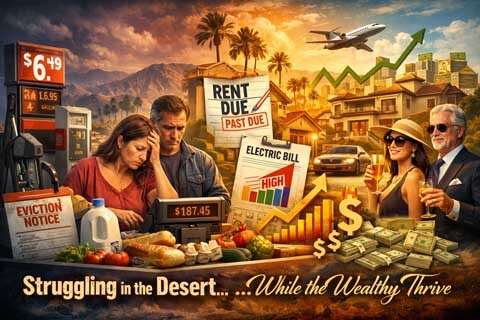

Cooling Numbers, Hot Prices: Why Paychecks Still Don’t Stretch in the Desert

On paper, the economy is finally doing what many Americans hoped it would do two years ago. Inflation has cooled, wages are rising modestly, and the panic headlines of 2022 have faded. Yet for households across the Coachella Valley and Greater Palm Springs, the cost of living remains stubbornly high—and in some cases, feels worse than ever.

Nationally, wages rose about 3.5 percent over the past year, while inflation slowed to roughly 2.7 percent. That gap should mean relief. In reality, it often doesn’t. The reason is simple but frustrating: prices rarely fall once they rise. Inflation slowing means costs are increasing more slowly, not that groceries, rent, insurance, or utilities are getting cheaper.

In desert communities, this disconnect is magnified. Housing costs remain elevated after years of rapid appreciation fueled by remote work migration and investor demand. Even as sales slow, rents have proven sticky. Landlords face higher insurance premiums, maintenance costs, and property taxes—and those increases are passed directly to tenants. For many local households, housing alone absorbs far more of their income than wage gains can offset.

Everyday expenses tell the same story. Groceries, gas, dining out, and electricity continue to take a larger bite out of monthly budgets. Energy costs are especially painful in hotter months, when air conditioning is not optional. These are “inelastic” expenses—families can’t easily cut back—so higher paychecks disappear quickly.

Who benefits when inflation cools but prices stay high? Largely, the companies and asset owners that were able to raise prices early and keep them there. Corporate profits surged during the high-inflation period, and many firms have been reluctant to reverse those increases. At the same time, higher interest rates have rewarded those with capital while squeezing those who rely on wages.

Data from Bank of America shows the imbalance clearly: higher-income households saw wage growth around 4 percent, while middle-income workers gained closer to 2.3 percent, and lower-income households just 1.4 percent. Because lower-income families spend a much larger share of their income on necessities, inflation hits them hardest—even when headline numbers improve.

This dynamic helps explain why wealth at the top continues to grow faster. Asset values, dividends, and pricing power favor those who already own more, while wage earners chase rising costs. Until housing, insurance, healthcare, and energy costs meaningfully stabilize—or competition forces prices down—the desert’s affordability challenge is unlikely to ease.

For Coachella Valley residents, the takeaway is sobering but clear: the economy may be healing, but it is not yet affordable. The numbers may look better in Washington and on Wall Street. At the checkout line and the rent office, the recovery still feels out of reach.

Desert Local News is an invitation-only, members-based publication built on fact-checked, non-biased journalism.

All articles are publicly visible and free to read, but participation is reserved for members—comments and discussion require an invitation to join.

We cover local, state, and world news with clarity and context, free from political agendas, outrage, or misinformation.