Notifications

News Staff

News Staff![]() -

April 28, 2022 -

Business -

Netflix

streaming services

Elon Musk

-

2.5K views -

0 Comments -

1 Like -

0 Reviews

-

April 28, 2022 -

Business -

Netflix

streaming services

Elon Musk

-

2.5K views -

0 Comments -

1 Like -

0 Reviews

'JTFmax'

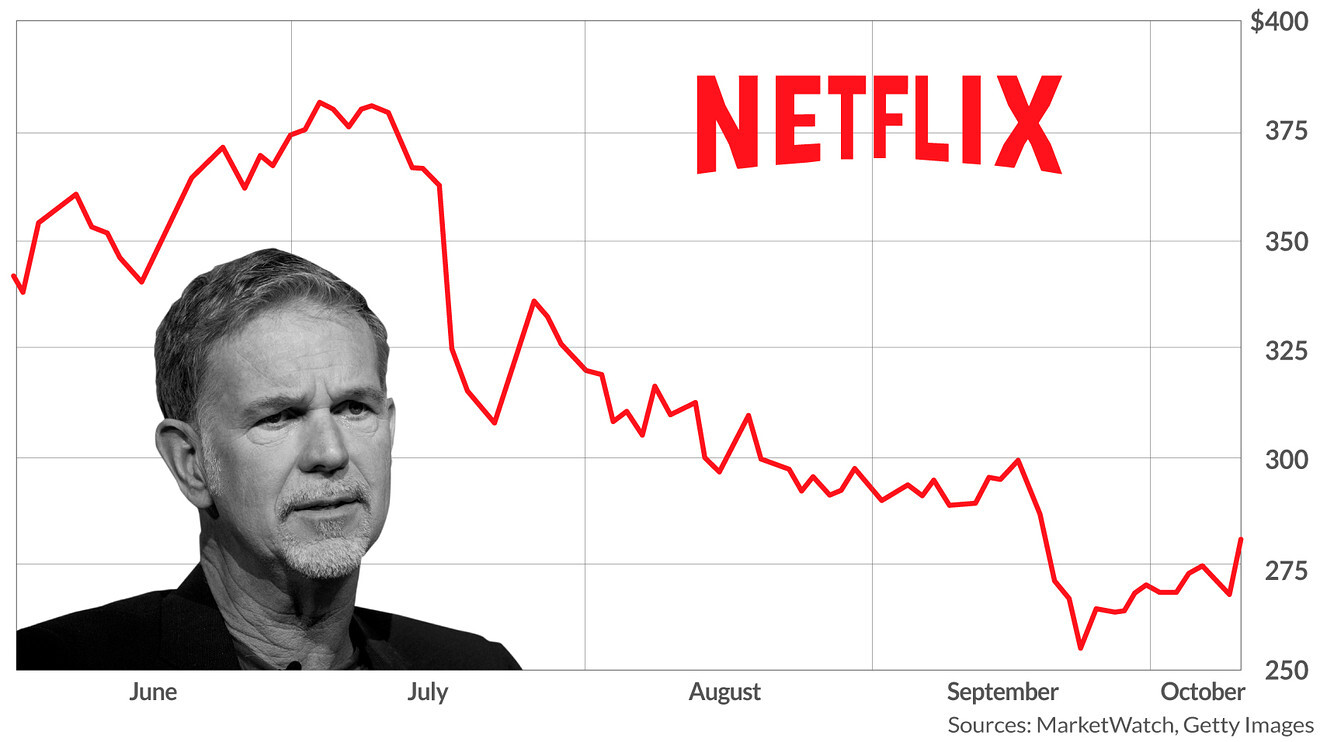

The plunge in Netflix's stock price could result from a "woke mind virus" that Elon Musk claims are the culprit behind the plunge. However, aside from the "woke mind virus," Netflix's market cap is also being affected by the slow growth of its service and competition from streaming rivals. Despite this, the company continues to raise its prices and makes more money per customer than it did in the previous quarter.

Elon Musk claims the "woke mind virus" is behind Netflix's plunge in the stock price

The Tesla CEO recently tweeted that Netflix's stock price plunge is due to a "woke mind virus." He claimed that the influx of 'woke' political views has rendered the streaming service unwatchable. In response, Netflix lost 200,000 subscribers in the first quarter of 2022 and braced itself to lose two million by the end of the second quarter. The company also received backlash for showing too much same-sex content and too many women in shows like Vikings Valhalla. The Netflix founder also pointed to controversial content in recent releases like "He's Expecting" and woke politics.

While the Pandemic, the Ukraine & Russian war created an economic crisis is a factor, Netflix is still losing subscribers at a faster rate than it was growing. As a result, the company has had trouble making movies and TV shows, and the drop in subscribers has hit investor confidence. In addition, Netflix's subscription rates have been affected for several years, and the company is now unable to cover its lost revenue. But the company does have other reasons for its recent stock price decline.

Netflix's slow growth is affecting its market cap

Shares of Netflix plunged 20% on Friday, losing $45bn. In the quarter, the streaming video service increased subscriptions by 6.7% and reported 1.6 billion in net income, down from 1.7 billion in the same period a year ago. The slow growth of subscribers is attributed to "Covid overhang" and macroeconomic hardship in some parts of the world. In January, Netflix blamed a pandemic for slow growth but now acknowledges that it was a mistake and cites structural issues as the leading cause of its sluggish growth.

As Netflix continues to fight the growing threat of online video streaming competition, it has faced slow growth in its subscriber base. Although the company recently released two of its most popular films, Netflix's growth in subscribers has been slow. Last year, the company added only 18.2 million new subscribers. In 2020, Netflix added 36 million new subscribers. While this is still a high number, the slow growth has caused investors to question whether the company can sustain its current growth rate.

It has lost 200k subscribers in the first quarter

While management initially expected a gain of 2.5 million net subscribers in the first quarter of the fiscal year 2020, the company recently revealed that it had shed 200,000 subscribers. As a result, Netflix is now forecasting a drop of 2 million in the second quarter. Netflix has blamed various factors, including increased competition, password sharing by members, and inflation. Regardless of the causes, the company's performance in the first quarter has caused the stock to plummet 35% in just one quarter.

In addition to the looming cost of streaming video, escalating inflation has squeezed household budgets, and consumers are reining in their discretionary spending. While Netflix recently increased prices in the U.S., it has trouble attracting new subscribers. As a result, it recently raised its prices and lost 640,000 subscribers in the U.S. and Canada. The company's subscribers haven't been as happy as the rest of the world, so it has rolled out new initiatives to attract more subscribers.

It faces intense competition from streaming rivals

The rising tide of streaming services threatens to drive people away from linear TV. The company recently wrote to investors about how this once-in-a-generation change would present opportunities for many players. But Netflix does not see these competitors as threats. Instead, it believes that everyone has more than enough streaming viewing time. Currently, Netflix holds less than ten percent of the television screen time in the U.S., a fraction of what rivals like Hulu and Amazon offer.

While Netflix remains the world's most popular movie-streaming service, it has faced intense competition from rivals. As a result, the company is losing its market share to newcomers, and the demand for its original shows has begun to fall relative to those of competitors. Last year, according to a recent report by Parrot Analytics, Netflix's share of global demand was only slightly higher than 50 percent. But despite its declining market share, Netflix's growth has a significant advantage over its rivals.

It is contemplating a lower-priced ad-supported tier

While streaming video giants such as Amazon and Hulu have long resisted introducing lower-cost ad-supported tiers, the service exploring such a move is a welcome development. The introduction of an ad-supported tier would bring in more money for Netflix, but it would sacrifice its superior user experience. So, the question remains: Will Netflix introduce an ad-supported tier anytime soon?

In its quarterly earnings conference call, Netflix co-founder and CEO Reed Hastings confirmed the company is considering offering a lower-priced tier with advertisements. Adding ads to the service was a decision Hastings has long opposed. But he said the company still believes in its business model and would cater to the desires of its customers. In addition, as the ad-supported tier would not be available for another year or two, the company may want to introduce it sooner than later.

It is considering cracking down on password sharing

Netflix is looking to crack down on the use of shared passwords on its platform, saying that a recent study found more than a hundred million households use shared passwords worldwide. This may cause the service to crack down on the practice, which has led to a significant decline in subscriptions. Netflix is also considering introducing advertising in its cheaper plans, a move it hopes will increase subscriptions. Although the decision has not been finalized yet, Netflix's CEO says the changes will help the company recover its momentum.

In Latin America, Netflix has already tested crackdowns on password sharing, including surcharges for accounts linked to multiple households. While these measures have largely failed to limit account sharing, the company is considering extending them internationally and charging extra for account sharing outside the home. Netflix has not revealed a clear global strategy, so there's still time to switch. For now, though, Netflix is testing these changes in Chile, Peru, and Chile.

Share this page with your family and friends.