Notifications

News Staff

News Staff![]() -

Aug 5 -

Business

Dow Jones 1

S&P 500

Nasdaq Composite

Oil down

-

440 views -

0 Comments -

0 Likes -

0 Reviews

-

Aug 5 -

Business

Dow Jones 1

S&P 500

Nasdaq Composite

Oil down

-

440 views -

0 Comments -

0 Likes -

0 Reviews

DLNews Business:

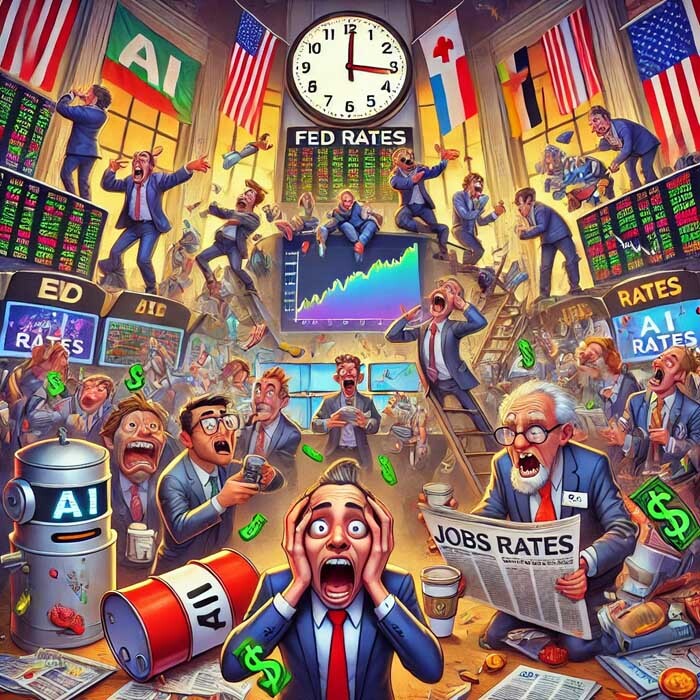

The global stock markets experienced significant volatility on Monday as concerns about a potential slowdown in the US economy sent ripples across financial markets worldwide. Early trading sessions saw dramatic declines, with substantial indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite suffering significant losses. While some recovery was observed by midday, investor sentiment remained largely apprehensive, influenced by multiple factors, including economic data and broader market trends.

Morning Session Performance

Dow Jones Industrial Average: Opened more than 1,000 points lower, down 2.3% by midday.

S&P 500: Declined by 4.25% at the opening, easing to a 2.7% loss by midday.

Nasdaq Composite: Plummeted over 6% initially, recovering slightly to a 3.2% decline.

The initial shock was severe, with the Dow dropping by over 1,000 points and other indices following suit. This early session downturn mirrored the worst fears about a looming economic slowdown in the United States, exacerbating concerns among global investors.

International Impact

The ripple effects of the US market turmoil were felt globally. Notably, Japanese stocks experienced their most significant drop since 1987, with the Nikkei 225 index closing over 12% lower. This highlights the interconnected nature of global financial markets, where economic signals from the US often have profound implications worldwide.

Key Drivers

1. Jobs Data: The unemployment rate's sudden rise to 4.3% raised alarms about economic growth. UBS economists highlighted that such a rapid increase has historically been associated with abrupt slowdowns. However, Goldman Sachs urged caution, suggesting that one month's data should be balanced, given the still strong labor market indicators, including millions of job openings.

2. Federal Reserve Actions: Expectations of interest rate cuts by the Federal Reserve have increased amid the slowdown fears. The Fed's potential leverage to adjust rates provides a balancing act for inflation and employment. Current interest rates are at a 23-year high, and the Fed has shown readiness to make significant adjustments when necessary.

3. Technology Sector: The tech sector, particularly AI-related stocks, has seen substantial gains this year, with companies like Nvidia up 104%, Apple up 10%, and Microsoft up 6%. While AI has driven optimism, there is a recognition that the sector's rapid growth may have led to overvaluation concerns. Nonetheless, tech remains a robust area, contributing to the overall market's resilience.

Oil Prices

Oil prices were still lower by Monday midday. West Texas Intermediate crude futures, the US benchmark, fell 0.8% to $72.92 a barrel, while Brent crude futures, the international benchmark, declined 0.1% to $76.31 a barrel. Crude prices have tumbled recently on concerns that a US recession could hurt oil demand. Worries about weak Chinese demand are also weighing on prices. This is despite fears that the Israel-Hamas war could widen after Iran threatened to avenge the killing of Hamas’ political leader in Tehran last week. Oil prices surged when the war first broke out last year, as investors worried that it could spread to other oil-producing areas of the Middle East.

Midday Recovery and Investor Sentiment

By midday, the stock market's losses had eased:

Dow Jones: 750 points lower (1.9% decline).

S&P 500: Down 2.1%.

Nasdaq Composite: Decreased by 2.5%.

As measured by the VIX (Wall Street's fear gauge), investor fear also showed signs of subsiding, dropping to roughly 34 from an earlier high of 65. This indicated a partial recovery in confidence among market participants.

Conclusion

While the stock market experienced a notable selloff driven by fears of an economic slowdown in the US, the situation exhibited signs of stabilization by midday. Key economic indicators and reassurances from financial analysts suggest that while caution is warranted, there is no immediate cause for panic. The Federal Reserve's potential interventions and the overall strength in sectors like technology provide a buffer against more severe downturns. Investors should maintain a balanced perspective and avoid overreacting to short-term market fluctuations.

Share this page with your family and friends.