Posted by - News Staff![]() \

\

April 8, 2025 \

Filed in - Business \

Nasdaq Composite Wall Street Nikkei \

1.5K views \ 0 reviews

From Spiral to Surge: Wall Street Rebounds Amid Global Tariff Tensions

Business Brief | April 8, 2025

By Max Liebermann

US and global stock markets mounted a dramatic comeback Tuesday following days of bruising losses fueled by tariff turmoil. Bargain-seeking investors and a glimmer of diplomatic hope sent the Dow up 930 points (2.45%), the S&P 500 rising 2.3%, and the Nasdaq jumping 2.5%. Markets around the world followed suit despite no concrete deal in sight.

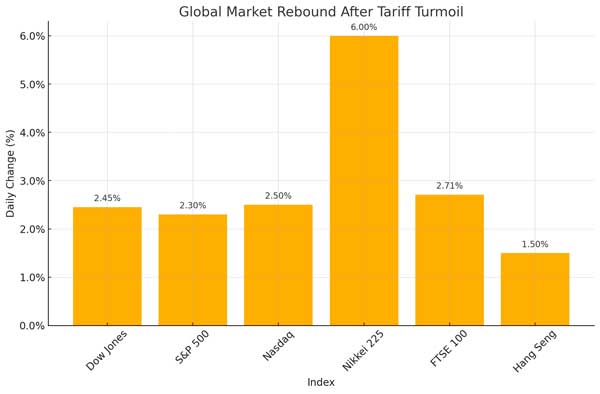

Like a gust of wind through a canyon of collapsing expectations, the markets surged in synchronized defiance of the economic gloom. Tokyo’s Nikkei soared 6%, London’s FTSE rose 2.7%, and Hong Kong’s Hang Seng clawed back after a historic one-day drop. Wall Street, never one to miss a show, lit up green with a sharp rally. Yet beneath the surface, investor sentiment remained guarded. The no-name traders—the 1,792 in motion behind 10,124 trades—offered each other half-smiles. It wasn’t a celebration. It was the look of survivors who’d just outrun something large and crashed.

On the policy front, the White House hinted at negotiations with key allies Japan and South Korea. National Economic Council Director Kevin Hassett said requests for trade talks are pouring in. President Trump confirmed "a great call" with South Korea's leadership and upcoming negotiations with Japan’s Prime Minister Shigeru Ishiba.

But China remains defiant. After being threatened with additional tariffs up to 70%, and possibly another 50% on top if it retaliates, China’s Commerce Ministry pledged to “fight to the end.” Meanwhile, the EU signaled readiness to import more US-liquefied natural gas to address trade imbalances.

Markets surged on the speculation, not the resolution. Wall Street’s fear gauge, the VIX, dropped 13%, and traders pounced on oversold assets as the S&P 500’s price-to-earnings ratio dipped below 17. Trump’s trade adviser, Peter Navarro, predicted a market renaissance, claiming “Dow 50,000” and “no recession.” However, JPMorgan CEO Jamie Dimon warned that tariffs could weaken global alliances and hurt American consumers. Elon Musk and Bill Ackman echoed similar concerns.

Higher import costs and global supply chain shocks remain a threat to businesses. For consumers, the fallout could mean pricier goods and pinched wallets. Though Tuesday’s rally was real, it may also be fleeting—a reflex, not a recovery.

As headlines chase hope, the market’s next move depends not on momentum but policy. In this high-stakes chess match of trade, the pieces are moving fast—but the outcome is far from checkmate.

📊 Global Market Rebound After Tariff Turmoil

💡 What This Means for You

For Consumers

Short-term market rallies may provide temporary relief, but continued tariff escalations could translate into higher prices on everyday goods—from electronics to groceries. Budget accordingly.

For Businesses

The rebound opens a window to reassess market positions, but uncertainty remains. Import-heavy sectors should brace for continued disruption in costs and logistics if trade talks fail.

For Investors

Volatility remains high. While rallies can be swift, they’re fragile. Diversification and policy awareness are critical in this environment. Consider this rebound an opportunity—not a resolution.

Desert Local News is an invitation-only, members-based publication built on fact-checked, non-biased journalism.

All articles are publicly visible and free to read, but participation is reserved for members—comments and discussion require an invitation to join.

We cover local, state, and world news with clarity and context, free from political agendas, outrage, or misinformation.

Comments