JustTheFacts Max

JustTheFacts Max![]() -

January 13, 2023 -

Business -

Debt Ceiling 2023

Janet Yellen

-

3.8K views -

0 Comments -

0 Likes -

0 Reviews

-

January 13, 2023 -

Business -

Debt Ceiling 2023

Janet Yellen

-

3.8K views -

0 Comments -

0 Likes -

0 Reviews

DLNews Money:

Treasury secretary Janet Yellen on Friday notified Congress that the U.S. would reach its statutory debt limit next Thursday. As a result, it is kicking off a potentially historic battle over its debt ceiling. While the U.S. government is currently well under the $32.4 trillion limit on borrowing set in December 2021, a failure to raise the debt limit could trigger an emergency, causing turmoil in the financial markets and a potential default on the nation's debt. The Treasury secretary's letter is a significant milestone in what is expected to be the most contentious debt limit battle in history, as Republicans will demand massive spending cuts from the federal budget in exchange for an increase in the debt ceiling.

Yellen's letter officially kicked off what's expected to be the most contentious debt ceiling battle in history. The United States could face its first credit default in history if it fails to raise its debt limit before the deadline in June. This would damage the country's economy and threaten global financial stability, according to the letter sent to lawmakers by Treasury Secretary Janet Yellen on Friday.

The United States has been close to its debt limit for the last several months, and the situation is expected to worsen shortly. The debt ceiling is a legal cap on the total amount of money the federal government can borrow through Treasury securities.

In the letter, Yellen said the Treasury Department would take "extraordinary measures" to avoid a default. These measures include suspending reinvestment in certain government retirement funds and paying bills on time.

While many analysts say the chances of a default are low, it's still possible that the government will miss a payment. If it does, it may affect the nation's credit rating, putting lending products such as mortgages at risk. It also can mean a government shutdown, which could halt critical services.

In addition to the monetary dangers, the debt ceiling could also create a political crisis. Republicans have pledged not to support a debt limit increase and have vowed to impose significant spending cuts during negotiations.

Democrats, however, have been one party in Washington for the past two years and could be forced to deal with a divided Capitol. They have a two-vote advantage in the Senate, but the House is now under Republican control.

Regardless of what happens, a debt limit dispute will be protracted. A failure to increase or suspend the debt ceiling could lead to a debt default and a government shutdown. That could lead to a recession and put millions of Americans out of work.

The debt limit is a hot topic on Wall Street and the White House. Both parties have spent countless hours wrangling over the latest bill and are preparing for the inevitable showdown. Hopefully, they will make the best possible deal. If they can't, the next few years may be a nightmare.

It's a shame that the debate is a drag on the economy. A new deficit has been imposed on the government, and there is a good chance that the federal government will run out of cash before the end of the year. On the upside, Congress has put a number on the debt limit, which could allow the federal government to borrow until late February or early March. Of course, this is the time of year when partisan bickering tends to make matters worse. But the government has a couple of tricks up its sleeve.

Among the first things to be tackled are Medicare and Social Security. However, the most critical piece of legislation is the debt limit. This is a big deal in a recessionary economy. For several reasons, Congress has been reluctant to raise the ceiling. One reason is that the Treasury Department has about $500 billion in excess reserves to draw on until the federal government runs out of cash. In addition, Congress can take a few "extraordinary measures" to soothe the jitters. As a result, the debate above will only rage for a short time.

House Republicans are demanding significant spending cuts to the federal budget in exchange for raising the debt limit, but it could lead to a partial shutdown later this year. The White House has rejected this idea, saying it would be "hostage taking."

Several measures are expected to reduce the federal budget by about 5-15 percent. They will reportedly include a reintroduction of the "Cut As You Go" rule, which requires equal reductions in mandatory and discretionary spending.

Another measure is the "YouCut" initiative, which allows the public to weigh in online on federal spending programs. Some measures include eliminating a requirement for the Government Printing Office to print hard copies of all bills, saving printing costs.

On Friday, House Speaker Kevin McCarthy (R-Calif.) invited President Biden — who promptly accepted — to deliver his annual State of the Union address on Feb. 7, 2023. The House also plans to pass a continuing resolution before that deadline. In addition, the House will likely vote on a non-security discretionary spending bill before the State of the Union Speech.

It is a safe bet that the House will use the debt ceiling as a bargaining chip, which is a logical move. However, if Democrats disagree with the proposed cuts, the GOP will almost certainly be forced to default.

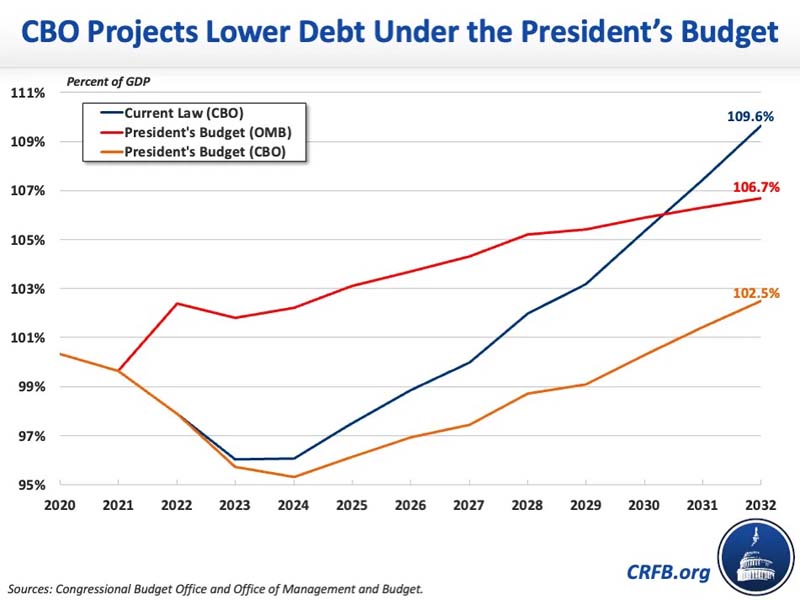

Although the congressional Budget Office (CBO) released its estimate of the President's Fiscal Year (FY) 2023 budget in September 2022, many congressional leaders have announced they plan to introduce a spending-cutting measure to raise the debt limit. The GOP has a track record of challenging budget demands when controlling the House.

Meanwhile, Democrats have resisted allowing the GOP to raise the debt limit without a cut, arguing that a default would create disastrous consequences. Unlike past showdowns, however, this time, there is a real threat to the nation's credit, and it appears that the White House will hold out for a deal.

If the United States defaults on its financial obligations, then it will have a devastating impact on the nation's economy. As a result, the Treasury Department is implementing extraordinary measures to help keep the government operating. They are designed to extend the time the government can spend paying its bills.

While the debt limit is set by law, Congress can raise it. Depending on political trends, the debate over raising the debt ceiling can be a highly contentious process. It is important to remember that the federal government is not permitted to issue any new debt once the debt limit has been reached.

When the Treasury Department runs up against the limit, it uses a variety of accounting maneuvers to preserve its borrowing capacity. These tactics include using money set aside to manage exchange rate fluctuations and borrowing from other sources.

Since the debt limit was set in 1985, the Treasury has used these "extraordinary measures" sixteen times. Some of the measures include suspending the reinvestment of the Government Securities Investment Fund and redeeming existing investments. In addition to these measures, the department has temporarily halted contributions to some federal pension funds.

If the debt ceiling is not raised, the Treasury will be forced to default on its financial obligations. This would increase the cost of borrowing and cause markets to be nervous. As a result, markets would demand higher interest rates to reflect the increased risk of a debt default.

Because the United States will not be able to issue new debt once the debt limit has been reached, the only way to avoid a debt default is to pass legislation. However, this is a highly protracted process. As a result, complicated negotiations could lead to a delay and inability to agree on legislation.

TREASURY SECRETARY WARNS US COULD DEFAULT ON ...

By JustTheFacts Max![]() 0

0

0

917

2

0

0

0

917

2

2 photos

Desert Local News is an invitation-only, members-based publication built on fact-checked, non-biased journalism.

All articles are publicly visible and free to read, but participation is reserved for members—comments and discussion require an invitation to join.

We cover local, state, and world news with clarity and context, free from political agendas, outrage, or misinformation.