JustTheFacts Max

JustTheFacts Max![]() -

March 15, 2023 -

Business -

Bank failures

Credit Suisse

-

3.5K views -

0 Comments -

0 Likes -

0 Reviews

-

March 15, 2023 -

Business -

Bank failures

Credit Suisse

-

3.5K views -

0 Comments -

0 Likes -

0 Reviews

Even a state bailout of Credit Suisse is already being discussed because of the severe crisis.

DLNews Biz:

German shares also plummet - National Bank wants to support Credit Suisse in case of emergency.

On Tuesday, the stock markets breathed a sigh of relief: Bank shares recovered somewhat from the fall in prices following the collapse of three U.S. banks. But now the financial crisis is spreading.

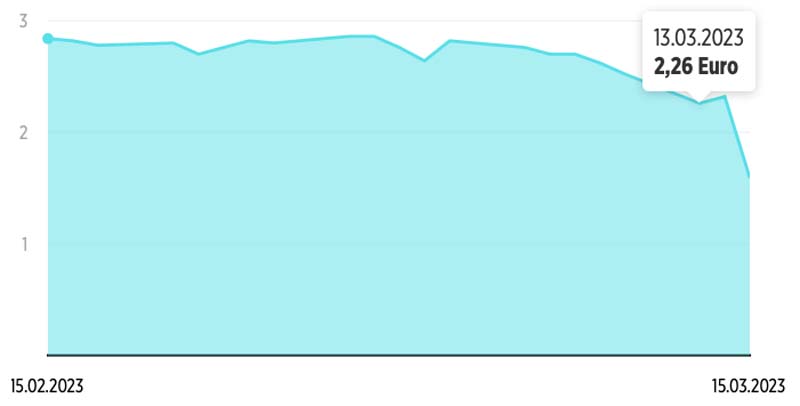

On Wednesday, the shares of Credit Suisse, the second-largest bank in the otherwise stable country of Switzerland, plummeted with full force.

They sometimes fell by a record 31 percent to an all-time low of 1.58 euros. Most recently, Credit Suisse was trading somewhat recovered at 1.86 euros (as of 6:27 p.m.). However, this still means a more than 20 percent loss on a single day on the stock exchange!

By comparison: In 2007, the share was still more than 97 euros.

The fall of Credit Suisse's share

The trigger for the current fall in the share price: in an interview with Bloomberg TV, the Saudi National Bank ruled out further support for Credit Suisse. The Saudi bank is a significant shareholder in the Swiss institution.

Chief: "We are a strong bank."

The bank is in a severe crisis. It has rapidly lost, and customers have been withdrawing money for months. In the fourth quarter of 2022, the bank recorded outflows of just over 110 billion. Customers started assets amounting to around 123 billion francs in the past fiscal year.

Ulrich Koerner Credit Suisse CEO

Will the bank now have to be rescued by the state? Possibly! The Swiss National Bank wants to provide Credit Suisse liquidity "if necessary." Reason: Credit Suisse is considered systemically important.

Meanwhile, Credit Suisse CEO Ulrich Körner (60) tries to reassure. "We are a strong, global bank under Swiss regulation; we meet and exceed all regulatory requirements," he said Wednesday in an interview with Asian broadcaster CNA. "Our capital and liquidity base is very, very strong."

Credit Suisse's crash caused share price tremors across Europe. The European banking index fell 6.7 percent. Switzerland's largest financial institution, UBS, plunged 8.5 percent at one point.

And in Germany, too, the effects were massive: the German share index (Dax) plummeted by more than three percent. Deutsche Bank and Commerzbank each lost more than seven percent.

NOW SWITZERLAND'S BANKING GIANTS ARE ALSO TRE...

By JustTheFacts Max![]() 0

0

0

891

3

0

0

0

891

3

3 photos

Desert Local News is an invitation-only, members-based publication built on fact-checked, non-biased journalism.

All articles are publicly visible and free to read, but participation is reserved for members—comments and discussion require an invitation to join.

We cover local, state, and world news with clarity and context, free from political agendas, outrage, or misinformation.